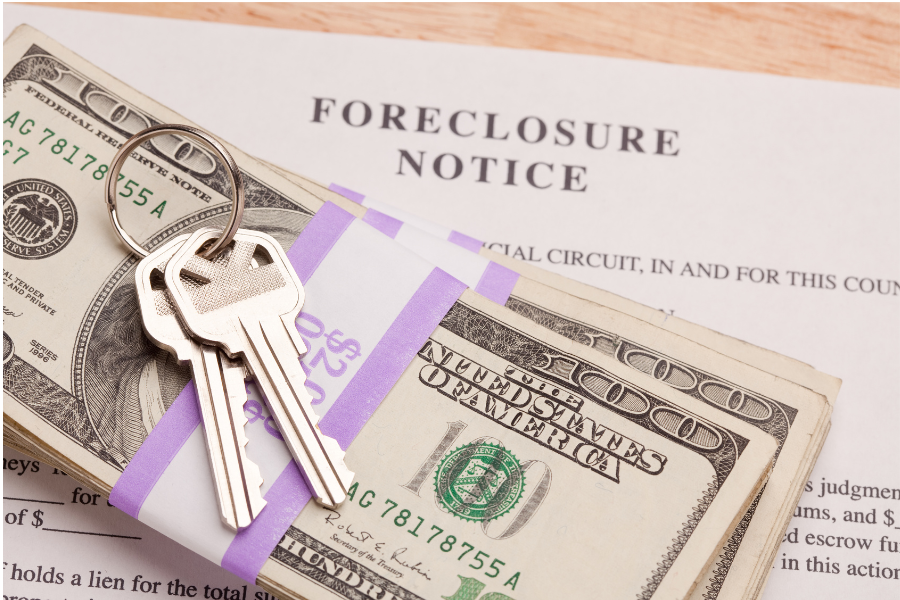

What is Foreclosure and its Implications on Your Finances

Foreclosure is a legal process that occurs when a homeowner is unable to make their mortgage payments, resulting in the lender taking possession of the property. This can have significant implications on your finances, leading to a wide range of negative consequences.

Firstly, having a foreclosure on your credit history can severely impact your credit score, making it difficult for you to secure loans or obtain good interest rates in the future. Additionally, the foreclosure process usually involves the sale of the property at a lower price than its market value, potentially leaving you with a considerable amount of debt still owed to the lender.

This can lead to financial instability and could even result in bankruptcy if the remaining balance is not resolved. Therefore, it is crucial to understand the implications of foreclosure and take proactive steps to avoid or mitigate the financial impact it can have on your life.

Understanding the Causes of Foreclosure

Foreclosure is a distressing situation that many homeowners may find themselves facing at some point. Understanding the causes behind this unfortunate circumstance can help individuals take necessary precautions to avoid it. One common cause of foreclosure is job loss or a significant decrease in income. When people are unable to meet their mortgage obligations due to unemployment or reduced wages, they may ultimately face the risk of losing their homes.

Another prevalent cause of foreclosure is overwhelming debt. When faced with mounting financial burdens such as credit card debt, medical bills, or unexpected expenses, homeowners may struggle to keep up with their mortgage payments. This can push them into a situation of defaulting on their loans, leading lenders to initiate foreclosure proceedings. It is crucial for individuals to manage their debts carefully and seek professional help to avoid the detrimental consequences of foreclosure.

Understanding the causes of foreclosure allows individuals to identify potential risk factors and take proactive measures to prevent this undesirable event. By staying vigilant and managing financial obligations responsibly, homeowners can navigate their financial journey with greater stability and reduce the likelihood of falling victim to foreclosure.

Recognizing the Warning Signs of Potential Foreclosure

One of the first warning signs that you may be headed towards foreclosure is when you start to fall behind on your mortgage payments. This can happen for a variety of reasons, such as a job loss, unexpected medical expenses, or a significant increase in your monthly bills. When you consistently struggle to make your mortgage payments on time, it is essential to take this as a serious indication that you may be at risk of foreclosure.

Another warning sign of a potential foreclosure is receiving multiple notices from your lender regarding late or missed payments. These notices serve as a clear indicator that your mortgage is in jeopardy and that action needs to be taken to address the issue. Ignoring these notifications or failing to respond to them can lead to further complications and increase the likelihood of foreclosure proceedings. It is crucial to remain proactive and seek immediate assistance if you find yourself in this situation.

Steps to Take When Facing Foreclosure

When facing the daunting reality of foreclosure, it is important to take immediate action to help secure your financial future. The first step is to communicate with your lender and inform them about your situation. Be honest about your difficulties and discuss potential options for avoiding foreclosure. This initial contact lays the foundation for potential negotiations and demonstrates your willingness to resolve the situation.

Following this, it is crucial to thoroughly review your financial situation and create a budget to help manage your expenses effectively. By cutting unnecessary costs and prioritizing essential payments, you can allocate funds towards your mortgage payments. It is also advisable to seek professional assistance from a financial advisor or housing counselor who can provide guidance on navigating the foreclosure process. They can offer valuable insights into potential alternatives to foreclosure and help you make informed decisions based on your unique circumstances.

Exploring Alternatives to Foreclosure

As homeowners facing the possibility of foreclosure, it is important to explore alternatives to help mitigate the financial impact. One possible option is loan modification, which involves negotiating with your lender to revise the terms of your mortgage. This could include reducing the interest rate, extending the loan term, or even forbearing payments for a period of time. However, it is crucial to keep in mind that not all lenders approve loan modifications, and the success of this alternative greatly depends on each individual's financial situation and the lender's willingness to work with borrowers.

Another alternative to foreclosure is a short sale. In a short sale, the homeowner sells their property for less than the outstanding mortgage balance. This option requires the approval of the lender, as they will need to agree to accept less than what is owed. While a short sale can be a viable solution, it is essential to understand that it can have implications on your credit score and may still leave you responsible for any remaining balance. Consulting with a real estate professional or a foreclosure specialist can provide valuable guidance on whether a short sale is a feasible alternative for your specific circumstances.

The Benefits of Selling Your Home for Cash

Selling your home for cash can offer a wide range of benefits. One of the main advantages is the speed of the transaction. Unlike traditional home sales, where the process can take several months or even years, selling your home for cash can often be completed in a matter of weeks. This can be especially beneficial if you need to sell your home quickly due to financial difficulties or other pressing circumstances.

Another advantage of selling your home for cash is the convenience it offers. When you sell your home for cash, you can avoid the lengthy and often stressful process of listing your home, finding a real estate agent, and dealing with potential buyers. Instead, you can sell your home directly to a cash buyer who will make you a fair offer based on the market value of your property. This can save you time and effort, allowing you to focus on other important aspects of your life. Whether you're facing foreclosure, relocating, or simply want to unload a property quickly, selling your home for cash can provide a convenient solution.

Finding a Reputable Cash Buyer for Your Property

When it comes to finding a reputable cash buyer for your property, it's important to do your due diligence. One of the best places to start is by asking for recommendations from friends, family, or colleagues who have gone through a similar situation. They may be able to provide valuable insights and point you in the direction of a trusted cash buyer.

Another option is to search online for cash buyers in your area. However, be cautious and thoroughly research any potential buyers before making a decision. Look for reviews or testimonials from previous clients to get an idea of their reputation and reliability. You can also check with local real estate associations or organizations to see if they have a list of reputable cash buyers that they can recommend.

Once you have a list of potential cash buyers, take the time to interview each one. Ask them about their experience in purchasing homes for cash, how quickly they can close a deal, and what their process entails. It's important to find someone who is trustworthy, transparent, and communicative throughout the process.

In the next section, we will discuss the importance of negotiating a fair cash offer for your home and how to navigate this process effectively.

Negotiating a Fair Cash Offer for Your Home

Negotiating a fair cash offer for your home is a crucial step in the selling process. When you receive an offer from a cash buyer, it's important to carefully evaluate it to ensure you are getting a fair deal. The first thing to consider is the price being offered for your property. Is it in line with the current market value? Do some research and compare recent sales of similar homes in your area to get a sense of what your home is really worth. Additionally, take into account any necessary repairs or renovations that may be required, as this can affect the overall value.

Aside from the price, it's also important to review the terms and conditions of the offer. Does the cash buyer require a quick closing or can you negotiate a more convenient timeline? Are there any contingencies or special requests that you need to consider? Evaluating these factors will help you determine if the offer is fair and aligns with your selling goals. Remember, don't be afraid to negotiate with the cash buyer to ensure you're getting the best deal possible. Open and honest communication can lead to a mutually beneficial agreement that satisfies both parties involved.

Understanding the Process of Selling Your Home for Cash

Selling your home for cash can be a straightforward and efficient process. After reaching out to a reputable cash buyer, they will typically schedule a time to evaluate your property. During the evaluation, the buyer will assess the condition of your home and compare it to recent sales in the area to determine a fair offer. Upon completion of the evaluation, the buyer will present you with a cash offer for your home.

If you decide to accept the offer, the next step is to finalize the sale. This often involves signing a purchase agreement and providing any necessary documentation. The buyer will then coordinate with a title company or attorney to ensure a smooth transfer of ownership. Once all the paperwork is in order, the buyer will typically schedule a closing date where you will receive the cash proceeds from the sale. Selling your home for cash can be a convenient option for those looking to achieve financial relief quickly and avoid the lengthy process of listing and selling through a traditional real estate agent.

Finalizing the Sale and Achieving Financial Relief

Finalizing the sale of your home for cash is the ultimate goal when facing foreclosure. This crucial step brings much-needed financial relief and allows you to move forward with a clean slate. Once you have found a reputable cash buyer for your property and negotiated a fair cash offer, the process of finalizing the sale can begin.

First, it is important to gather all necessary documents and paperwork required for the sale. This includes the title deed, proof of ownership, any outstanding liens or mortgages, and other relevant paperwork. Working closely with your cash buyer and a real estate attorney, you can ensure that all legal formalities are followed and the transfer of ownership is smooth. Once the paperwork is completed and signed, the next step is the closing of the sale, where the cash buyer provides the agreed-upon amount and you transfer the ownership of the property. This final step brings a sense of closure to the challenging journey of facing foreclosure and allows you to achieve the much-needed financial relief you have been striving for.